前些天发布了,多因子模型(一)-因子生成 (针对聚宽新增多因子相关功能)。

这周按照计划又重新整理了 多因子模型(二)-因子检验 这部分。步入正题:

第一步,读取上一篇因子生成的的因子,如果第一次看到这篇帖子的朋友可有查看 多因子模型(一)-因子生成。

第二步,针对因子进行一系列计算,来判断哪些因子是有效的。其中包括以下几点:

- IC的平均值的绝对值,以及ICIR。IC的意思就是每一个时间截面因子暴露和下一期回报的相关系数。举例,在3月1日每只股票的ROE因子,3月1日到4月1日的回报,这两组数字的相关系数。ICIR是IC的绝对值除以IC的标准差。理论上,IC均值的绝对值越大,因子效果越显著,同理,ICIR。

2.分组收益。对于单个因子,我们把因子从大到小排列。取前10%的股票作为一个组合,然后10%-20%,20%-30%,以此类推,一共10个组合。分别计算各个组合的收益率。分组收益这里有两个方程,一个是每日的组合收益,还有一个是以调仓频率的组合收益。前者用于后续计算一些组合指标。

3.计算回测区间指数的收益率,目的在于计算超额收益。

4.进行因子有效性测试。其中包括:

4.1 组合序列与组合收益的相关性,相关性大于0.5

4.2 赢家组合明显跑赢市场,输家组合明显跑输市场,程度大于5%

4.3 高收益组合跑赢基准的概率,低收益组合跑赢基准的概率,概率大小0.5

这里要注意的是赢家和输家要区分一下,因为有些因子是越大越好,有些是越小越好。

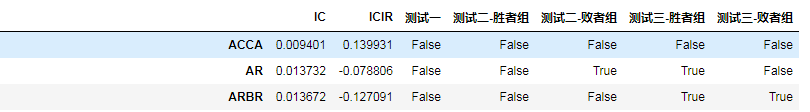

第三步,我们观测一下统计结果。EffectTestresult,下图未完全显示。

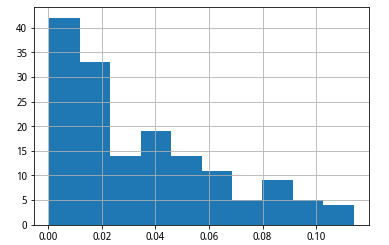

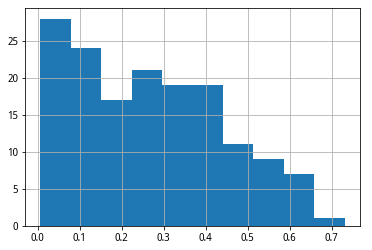

然后观察IC平均值,和ICIR的分布情况。

通过观察,我主观决定,筛选标准如下:

IC均值绝对值大于0.07,ICIR绝对值大于0.4,测试一,测试二-胜者组,测试三-胜者组,必须通过

测试二、测试三中要至少通过3个。

欢迎大家采用其他的筛选标准来最优化组合,在第二步的4中,也可以调整一下测试标准,4的检验结果存在变量effect_test_score_dict中。

通过筛选,我们得到了如下因子:

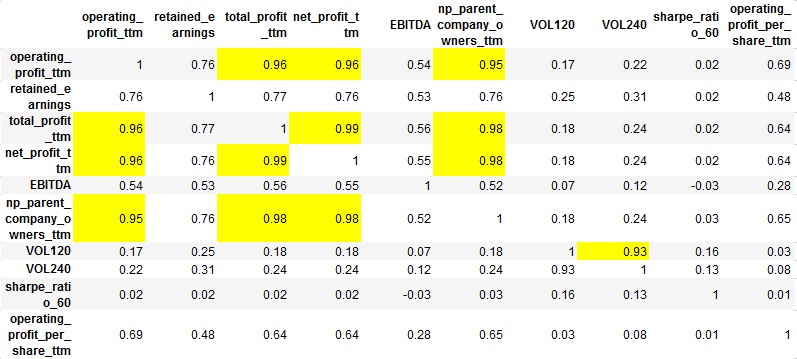

我们发现有很多因子非常相似,比如不同日期的vol,以及各种profit。所以我们需要剔除一些高度相关的因子。

如何计算因子的相关性呢。我们把股票对应因子数换成该股票所在的分组数。然后计算在同一时期,不同因子的股票分组序列的相关系数。由于我们有很多期,所以需要将这些相关系数矩阵取平均,得到的结果如下:

结合上面因子和测试结果,最后我剔除了['operating_profit_ttm','net_profit_ttm','np_parent_company_owners_ttm','VOL120'],这四个因子。因为IC,ICIR略差些,相比于同类因子。

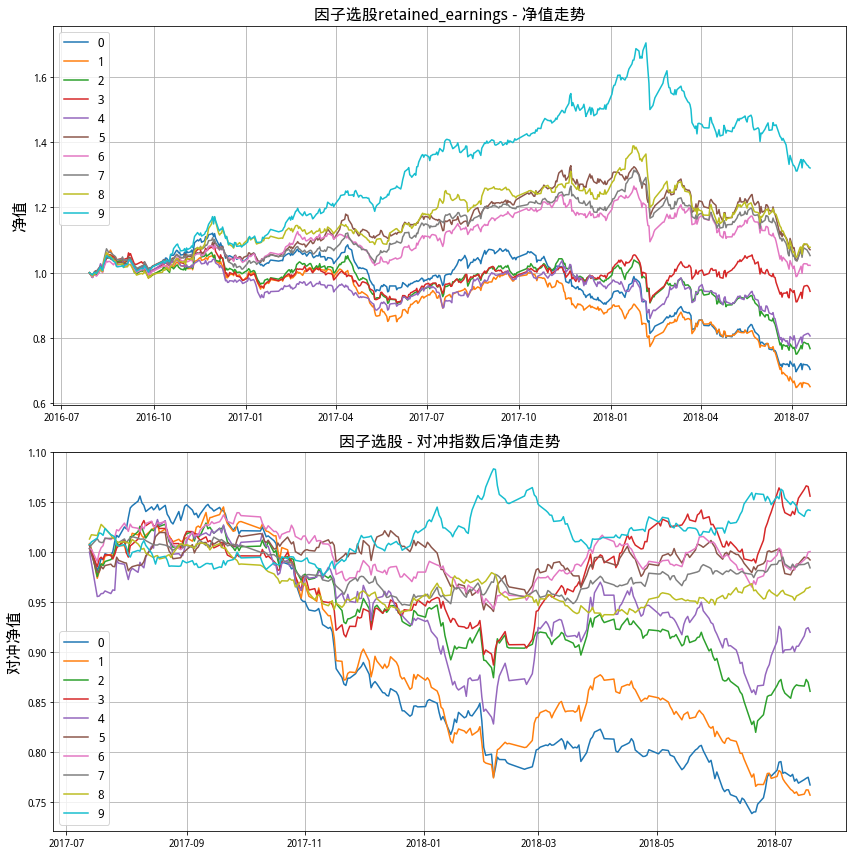

对于最后筛选出的因子,画出10分组的收益图,比如说:

因子的分组组合统计,比如说:

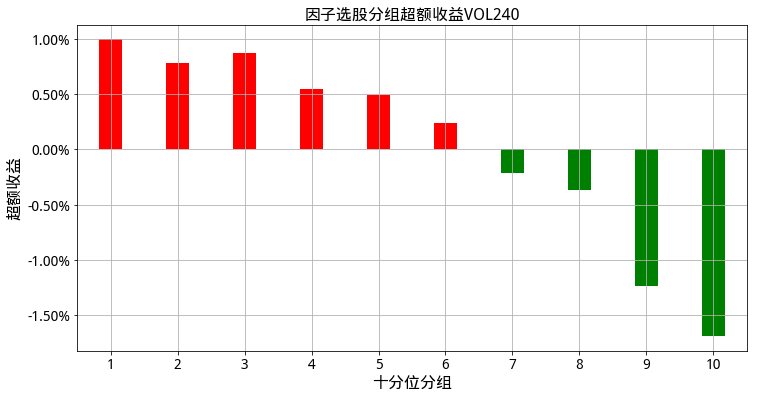

因子的超额收益图,比如说:

图看起来基本上都体面。

下一次,就是把这些有效因子带入回测模块了。Good Luck~!

大家多多交流,欢迎批评指正。

# Step I: 读取第一步因子生成的数据数据

import time

import datetime

import jqdata

import datetime

from multiprocessing.dummy import Pool as ThreadPool

from jqfactor import Factor,calc_factors

import pandas as pd

import statsmodels.api as sm

import scipy.stats as st

import pickle

pkl_file = open('MyPackage.pkl', 'rb')

load_Package = pickle.load(pkl_file)

g_univ_dict,return_df,all_return_df,raw_factor_dict,all_factor_dict,all_industry_df=load_Package

univ_dict=g_univ_dict

#factor_dict={}

#factor_dict['cfo_to_ev']=all_factor_dict['cfo_to_ev']

#all_factor_dict=factor_dict

# Step II: 因子筛选用到的函数

def ic_calculator(factor,return_df,univ_dict):

ic_list=[]

p_value_list=[]

for date in list(univ_dict.keys()): #这里是循环

univ=univ_dict[date]

univ=list(set(univ)&set(factor.loc[date].dropna().index)&set(return_df.loc[date].dropna().index))

if len(univ)<10:

continue

factor_se=factor.loc[date,univ]

return_se=return_df.loc[date,univ]

ic,p_value=st.spearmanr(factor_se,return_se)

ic_list.append(ic)

p_value_list.append(p_value)

return ic_list

# 1.回测基础数据计算

def all_Group_Return_calculator(factor,univ_dict,all_return_df,GroupNum=10):

all_date_list=list(all_return_df.index)

date_list=list(univ_dict.keys())

all_Group_Ret_df=pd.DataFrame(index=all_date_list,columns=list(np.array(range(GroupNum))))

for n in range(len(date_list)-1):

start=date_list[n]

end=date_list[n+1]

univ=univ_dict[start]

univ=set(univ)&set(factor.loc[start].dropna().index)

factor_se_stock=list(factor.loc[start,univ].dropna().sort_values().index)

N=len(factor_se_stock)

for i in range(GroupNum):

group_stock=factor_se_stock[int(N/GroupNum*i):int(N/GroupNum*(i+1))]

# 下面两行是关键

cumret=(all_return_df.loc[start:end,group_stock]+1).cumprod().mean(axis=1)

all_Group_Ret_df.loc[start:end,i]=cumret.shift(1).fillna(1).pct_change().shift(-1)

#(((all_return_df.loc[start:end,group_stock]+1).cumprod()-1).mean(axis=1)+1).pct_change().shift(-1)

all_Group_Ret_df=all_Group_Ret_df[date_list[0]:].shift(1).fillna(0)

return all_Group_Ret_df

def Group_Return_calculator(factor,univ_dict,return_df,GroupNum=10):

GroupRet_df=pd.DataFrame(index=list(list(univ_dict.keys())),columns=list(np.array(range(GroupNum))))

for date in list(univ_dict.keys()): #这个也是个循环

univ=univ_dict[date]

univ=list(set(univ)&set(factor.loc[date].dropna().index)&set(return_df.loc[date].dropna().index))

factor_se_stock=list(factor.loc[date,univ].sort_values().index)

N=len(factor_se_stock)

for i in range(GroupNum):

group_stock=factor_se_stock[int(N/GroupNum*i):int(N/GroupNum*(i+1))]

GroupRet_df.loc[date,i]=return_df.loc[date,group_stock].mean()

return GroupRet_df.shift(1).fillna(0)

def get_index_return(univ_dict,index,count=250):

trade_date_list=list(univ_dict.keys())

date=max(trade_date_list)

price=get_price(index,end_date=date,count=count,fields=['close'])['close']

price_return=price.loc[trade_date_list[0]:].pct_change().fillna(0)

price_return_by_tradeday=price.loc[trade_date_list].pct_change().fillna(0)

return price_return,price_return_by_tradeday

def effect_test(univ_dict,key,group_return,group_excess_return):

daylength=(list(univ_dict.keys())[-1]-list(univ_dict.keys())[0]).days

annual_return=np.power(cumprod(group_return+1).iloc[-1,:],365/daylength)

index_annual_return=np.power((index_return+1).cumprod().iloc[-1],365/daylength)

# Test One: 组合序列与组合收益的相关性,相关性大于0.5

sequence=pd.Series(np.array(range(10)))

test_one_corr=annual_return.corr(sequence)

test_one_passgrade=0.5

test_one_pass=abs(test_one_corr)>test_one_passgrade

if test_one_corr<0:

wingroup,losegroup=0,9

else:

wingroup,losegroup=9,0

# Test Two: 赢家组合明显跑赢市场,输家组合明显跑输市场,程度大于5%

test_two_passgrade=0.05

test_two_win_excess=annual_return[wingroup]-index_annual_return

test_two_win_pass=test_two_win_excess>test_two_passgrade

test_two_lose_excess=index_annual_return-annual_return[losegroup]

test_two_lose_pass=test_two_lose_excess>test_two_passgrade

test_two_pass=test_two_win_pass&test_two_lose_pass

# Test Tree: 高收益组合跑赢基准的概率,低收益组合跑赢基准的概率,概率大小0.5

test_three_grade=0.5

test_three_win_prob=(group_excess_return[wingroup]>0).sum()/len(group_excess_return[wingroup])

test_three_win_pass=test_three_win_prob>0.5

test_three_lose_prob=(group_excess_return[losegroup]<0).sum()/len(group_excess_return[losegroup])

test_three_lose_pass=test_three_lose_prob>0.5

test_three_pass=test_three_win_pass&test_three_lose_pass

test_result=[test_one_pass,test_two_win_pass,test_two_lose_pass,test_three_win_pass,test_three_lose_pass]

test_score=[test_one_corr,test_two_win_excess,test_two_lose_excess,test_three_win_prob,test_three_lose_prob]

return test_result,test_score

# 计算每个因子的评分和筛选结果

starttime=time.clock()

print('\n计算IC_IR:')

count=1

ic_list_dict={}

for key,factor in all_factor_dict.items():

ic_list=ic_calculator(factor,return_df,univ_dict)

ic_list_dict[key]=ic_list

print(count,end=',')

count=count+1

# 整理结果

ic_df=pd.DataFrame(ic_list_dict,index=list(univ_dict.keys())[:-1])

ic_ir_se=ic_df.mean()/ic_df.std()

ic_avg_se=ic_df.mean().abs()

print('\n计算分组收益:')

count=1

GroupNum=10

all_Factor_Group_Return_dict={} ##这个用于计算NAV,再筛选出因子之后再用更效率

Factor_Group_Return_dict={}

for key,factor in all_factor_dict.items():

# 全return

all_GroupRet_df=all_Group_Return_calculator(factor,univ_dict,all_return_df,GroupNum)

all_Factor_Group_Return_dict[key]=all_GroupRet_df

# 调仓期return

GroupRet_df=Group_Return_calculator(factor,univ_dict,return_df,GroupNum)

Factor_Group_Return_dict[key]=GroupRet_df

print(count,end=',')

count=count+1

print('\n计算指数收益:')

count=1

index='000300.XSHG'

index_return,index_return_by_tradeday=get_index_return(univ_dict,index)

Factor_Group_Excess_Return_dict={}

for key,group_return in Factor_Group_Return_dict.items():

Factor_Group_Excess_Return_dict[key]=group_return.subtract(index_return_by_tradeday,axis=0)

print(count,end=',')

count=count+1

print('\n因子有效性测试:')

count=1

effect_test_result_dict={}

effect_test_score_dict={}

for key,group_return in Factor_Group_Return_dict.items():

group_excess_return=Factor_Group_Excess_Return_dict[key]

effect_test_result_dict[key],effect_test_score_dict[key]=effect_test(univ_dict,key,group_return,group_excess_return)

print(count,end=',')

count=count+1

print('\npickle序列化')

Package_ET=[ic_avg_se,ic_ir_se,effect_test_result_dict,effect_test_score_dict,\

all_Factor_Group_Return_dict,Factor_Group_Return_dict,index_return,index_return_by_tradeday,\

Factor_Group_Excess_Return_dict]

pkl_file = open('MyPackage_ET.pkl', 'wb')

pickle.dump(Package_ET,pkl_file,0)

pkl_file.close()

endtime=time.clock()

runtime=endtime-starttime

print('因子测试运行完成,用时 %.2f 秒' % runtime)

# 读取因子

import pickle

pkl_file = open('MyPackage_ET.pkl', 'rb')

load_Package = pickle.load(pkl_file)

ic_avg_se,ic_ir_se,effect_test_result_dict,effect_test_score_dict,\

all_Factor_Group_Return_dict,Factor_Group_Return_dict,index_return,index_return_by_tradeday,\

Factor_Group_Excess_Return_dict=load_Package

EffectTestresult=pd.concat([ic_avg_se.to_frame('a'),ic_ir_se.to_frame('b'),pd.DataFrame(effect_test_result_dict).T],axis=1)

columns=['IC','ICIR','测试一', '测试二-胜者组', '测试二-败者组', '测试三-胜者组', '测试三-败者组']

EffectTestresult.columns=columns

EffectTestresult2=pd.concat([ic_avg_se.to_frame('a'),ic_ir_se.to_frame('b'),pd.DataFrame(effect_test_score_dict).T],axis=1)

columns=['IC','ICIR','测试一', '测试二-胜者组', '测试二-败者组', '测试三-胜者组', '测试三-败者组']

EffectTestresult2.columns=columns

EffectTestresult

EffectTestresult['IC'].sort_values(ascending=False).hist()

EffectTestresult['ICIR'].abs().sort_values(ascending=False).hist()

#筛选有效因子

# IC大于0.07,ICIR大于0.4,测试一,测试二-胜者组,测试三-胜者组,必须通过

# 测试二、测试三中要至少通过3个。

index_ic=EffectTestresult['IC']>0.07

index_icir=EffectTestresult['ICIR'].abs()>0.4

test_index=all(EffectTestresult.iloc[:,[2,3,5]],axis=1)

test2_index=sum(EffectTestresult.iloc[:,3:6],axis=1)>=3

filter_index=index_ic&index_icir&test_index&test2_index

EffectFactorresult=EffectTestresult.loc[filter_index,:]

# 生成有效因子字典

EffectFactor=list(EffectFactorresult.index)

Effect_factor_dict={key:value for key,value in all_factor_dict.items() if key in EffectFactor}

EffectFactorresult

def Group_Score_calculator(factor,univ_dict,signal,GroupNum=20):

Score_df=pd.DataFrame(index=list(factor.index),columns=list(factor.columns))

for date in list(univ_dict.keys()): #这个也是个循环

univ=univ_dict[date]

univ=list(set(univ)&set(factor.loc[date].dropna().index))

factor_se_stock=list(factor.loc[date,univ].sort_values().index)

N=len(factor_se_stock)

for i in range(GroupNum):

group_stock=factor_se_stock[int(N/GroupNum*i):int(N/GroupNum*(i+1))]

if signal=='ascending':

Score_df.loc[date,group_stock]=i

else:

Score_df.loc[date,group_stock]=GroupNum-i

return Score_df

# 计算相关性矩阵

def factor_corr_calculator(Group_Score_Dict,univ_dict):

Group_Score_dict_by_day={}

Group_Score_Corr_dict_by_day={}

# 每日的因子序列

for Date in list(univ_dict.keys()):

Group_Score_df=pd.DataFrame()

univ=univ_dict[Date]

for Factor in list(Group_Score_dict.keys()):

Group_Score_df=Group_Score_df.append(Group_Score_dict[Factor].loc[Date,univ].to_frame(Factor).T)

Group_Score_dict_by_day[Date]=Group_Score_df.T.fillna(4.5)

Group_Score_Corr_dict_by_day[Date]=Group_Score_dict_by_day[Date].corr()

# 算平均数

N=len(list(univ_dict.keys()))

Group_Score_Corr=Group_Score_Corr_dict_by_day[list(univ_dict.keys())[0]]

for Date in list(univ_dict.keys())[1:]:

Group_Score_Corr=Group_Score_Corr+Group_Score_Corr_dict_by_day[Date]

return (Group_Score_Corr/N).round(2)

# 给因子赋值

Group_Score_dict={}

for key,factor in Effect_factor_dict.items():

signal='ascending' if ic_ir_se[key]>0 else 'descending'

Group_Score_dict[key]=Group_Score_calculator(factor,univ_dict,signal,20)

# 计算因子相关系数

factor_corrmatrix=factor_corr_calculator(Group_Score_dict,univ_dict)

factor_corrmatrix

# 比较后去掉一些因子

# operating_profit_ttm,net_profit_ttm,np_parent_company_owners_ttm,VOL120

removed_factor=['operating_profit_ttm','net_profit_ttm','np_parent_company_owners_ttm','VOL120']

Effect_factor_dict={key:value for key,value in Effect_factor_dict.items() if key not in removed_factor}

def plot_nav(all_return_df,index_return,key):

# Preallocate figures

fig = plt.figure(figsize=(12,12))

fig.set_facecolor('white')

fig.set_tight_layout(True)

ax1 = fig.add_subplot(211)

ax2 = fig.add_subplot(212)

ax1.grid()

ax2.grid()

ax1.set_ylabel(u"净值", fontsize=16)

ax2.set_ylabel(u"对冲净值", fontsize=16)

ax1.set_title(u"因子选股{} - 净值走势".format(key),fontsize=16)

ax2.set_title(u"因子选股 - 对冲指数后净值走势", fontsize=16)

# preallocate data

date=list(all_return_df.index)

sequence=all_return_df.columns

# plot nav

for sq in sequence:

nav=(1+all_return_df[sq]).cumprod()

nav_excess=(1+all_return_df[sq]-index_return).cumprod()

ax1.plot(date,nav,label=str(sq))

ax2.plot(date,nav_excess,label=str(sq))

ax1.legend(loc=0,fontsize=12)

ax2.legend(loc=0,fontsize=12)

def polish(x):

return '%.2f%%' % (x*100)

def result_stats(key,all_return_df,index_return):

# Preallocate result DataFrame

sequences=all_return_df.columns

cols = [(u'风险指标', u'Alpha'), (u'风险指标', u'Beta'), (u'风险指标', u'信息比率'), (u'风险指标', u'夏普比率'),

(u'纯多头', u'年化收益'), (u'纯多头', u'最大回撤'), (u'纯多头', u'收益波动率'),

(u'对冲后', u'年化收益'), (u'对冲后', u'收益波动率')]

columns = pd.MultiIndex.from_tuples(cols)

result_df = pd.DataFrame(index = sequences,columns=columns)

result_df.index.name = "%s" % (key)

for sq in sequences: #循环在这里开始

# 净值

return_data=all_return_df[sq]

return_data_excess=return_data-index_return

nav=(1+return_data).cumprod()

nav_excess=(1+return_data_excess).cumprod()

nav_index=(1+index_return).cumprod()

# Beta

beta=return_data.corr(index_return)*return_data.std()/index_return.std()

beta_excess=return_data_excess.corr(index_return)*return_data_excess.std()/index_return.std()

#年化收益

daylength=(return_data.index[-1]-return_data.index[0]).days

yearly_return=np.power(nav.iloc[-1],1.0*365/daylength)-1

yearly_return_excess=np.power(nav_excess.iloc[-1],1.0*365/daylength)-1

yearly_index_return=np.power(nav_index.iloc[-1],1.0*365/daylength)-1

# 最大回撤 其实这个完全看不懂

max_drawdown=max([1-v/max(1,max(nav.iloc[:i+1])) for i,v in enumerate(nav)])

#max_drawdown_excess=max([1-v/max(1,max(nav_excess.iloc[:i+1])) for i,v in enumerate(nav_excess)])

# 波动率

vol=return_data.std()*sqrt(252)

vol_excess=return_data_excess.std()*sqrt(252)

# Alpha

rf=0.04

alpha=yearly_return-(rf+beta*(yearly_return-yearly_index_return))

alpha_excess=yearly_return_excess-(rf+beta_excess*(yearly_return-yearly_index_return))

# 信息比率

ir=(yearly_return-yearly_index_return)/(return_data_excess.std()*sqrt(252))

# 夏普比率

sharpe=(yearly_return-rf)/vol

# 美化打印

alpha,yearly_return,max_drawdown,vol,yearly_return_excess,vol_excess=\

map(polish,[alpha,yearly_return,max_drawdown,vol,yearly_return_excess,vol_excess])

sharpe=round(sharpe,2)

ir=round(ir,2)

beta=round(ir,2)

result_df.loc[sq]=[alpha,beta,ir,sharpe,yearly_return,max_drawdown,vol,yearly_return_excess,vol_excess]

return result_df

def draw_excess_return(excess_return,key):

excess_return_mean=excess_return[1:].mean()

excess_return_mean.index = map(lambda x:int(x)+1,excess_return_mean.index)

excess_plus=excess_return_mean[excess_return_mean>0]

excess_minus=excess_return_mean[excess_return_mean<0]

fig = plt.figure(figsize=(12, 6))

fig.set_facecolor('white')

ax1 = fig.add_subplot(111)

ax1.bar(excess_plus.index, excess_plus.values, align='center', color='r', width=0.35)

ax1.bar(excess_minus.index, excess_minus.values, align='center', color='g', width=0.35)

ax1.set_xlim(left=0.5, right=len(excess_return_mean)+0.5)

ax1.set_ylabel(u'超额收益', fontsize=16)

ax1.set_xlabel(u'十分位分组', fontsize=16)

ax1.set_xticks(excess_return_mean.index)

ax1.set_xticklabels([int(x) for x in ax1.get_xticks()], fontsize=14)

ax1.set_yticklabels([str(x*100)+'0%' for x in ax1.get_yticks()], fontsize=14)

ax1.set_title(u"因子选股分组超额收益{}".format(key), fontsize=16)

ax1.grid()

for key in list(Effect_factor_dict.keys()):

plot_nav(all_Factor_Group_Return_dict[key],index_return,key)

result_dict={}

for key in list(Effect_factor_dict.keys()):

result_df=result_stats(key,all_Factor_Group_Return_dict[key],index_return)

result_dict[key]=result_df

print(result_df)

result_dict['VOL240']

for key in list(Effect_factor_dict.keys()):

draw_excess_return(Factor_Group_Excess_Return_dict[key],key)